Gift Tax Limits 2025. But those limits will drop by roughly half. To navigate federal gift tax, most people leverage exemptions.

In 2025, the internal revenue service (irs) increased the limits for both the gift tax exclusion and the lifetime estate and gift tax exemption to the highest amounts in. Lifetime estate and gift tax exemption thresholds are poised to be cut in half at the stroke of midnight december 31, 2025, leading to a potentially sharp jump in.

In 2025, An Individual Can Make A Gift Of Up To $18,000 A Year To Another Individual Without Federal Gift Tax Liability.

Elevated gift tax exclusions will sunset after 2025.

Annual Federal Gift Tax Exclusion.

A gift tax is a tax that can be imposed on the transfer of money or property from one person to another.

Gift Tax Limits 2025 Images References :

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, The lifetime gift tax exemption allows you to make large gifts without incurring gift taxes. The irs has confirmed that those who take advantage of the temporary estate and lifetime gift tax exclusion will not face adverse tax consequences once the.

Source: www.adviceperiod.com

Source: www.adviceperiod.com

Federal Estate and Gift Tax Exemption to Sunset in 2025 Are You Ready, In 2023, you can gift $17,000 a year to as many people as you want. The irs has confirmed that those who take advantage of the temporary estate and lifetime gift tax exclusion will not face adverse tax consequences once the.

Source: www.sprouselaw.com

Source: www.sprouselaw.com

A Guide for Understanding the U.S. Federal Gift Tax Rules Sprouse, Budget 2025 may bring income tax rate cuts and raise the income threshold to ₹5 lakh, as per various media reports. For those who have acquired enough wealth to surpass.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, The irs has confirmed that those who take advantage of the temporary estate and lifetime gift tax exclusion will not face adverse tax consequences once the. One is the annual gift tax exclusion, also known as.

Source: www.aotax.com

Source: www.aotax.com

Annual Gift Tax Limitations Advantage One Tax Consulting, A gift tax is a tax paid for gifts you give over the annual gift tax exclusion amount. Annual federal gift tax exclusion.

Source: diversifiedllctax.com

Source: diversifiedllctax.com

How to Avoid the Gift Tax? Diversified Tax, The lifetime gift tax exemption allows you to make large gifts without incurring gift taxes. To navigate federal gift tax, most people leverage exemptions.

Source: fity.club

Source: fity.club

Gift Tax Wedding, But those limits will drop by roughly half. A gift tax is a tax that can be imposed on the transfer of money or property from one person to another.

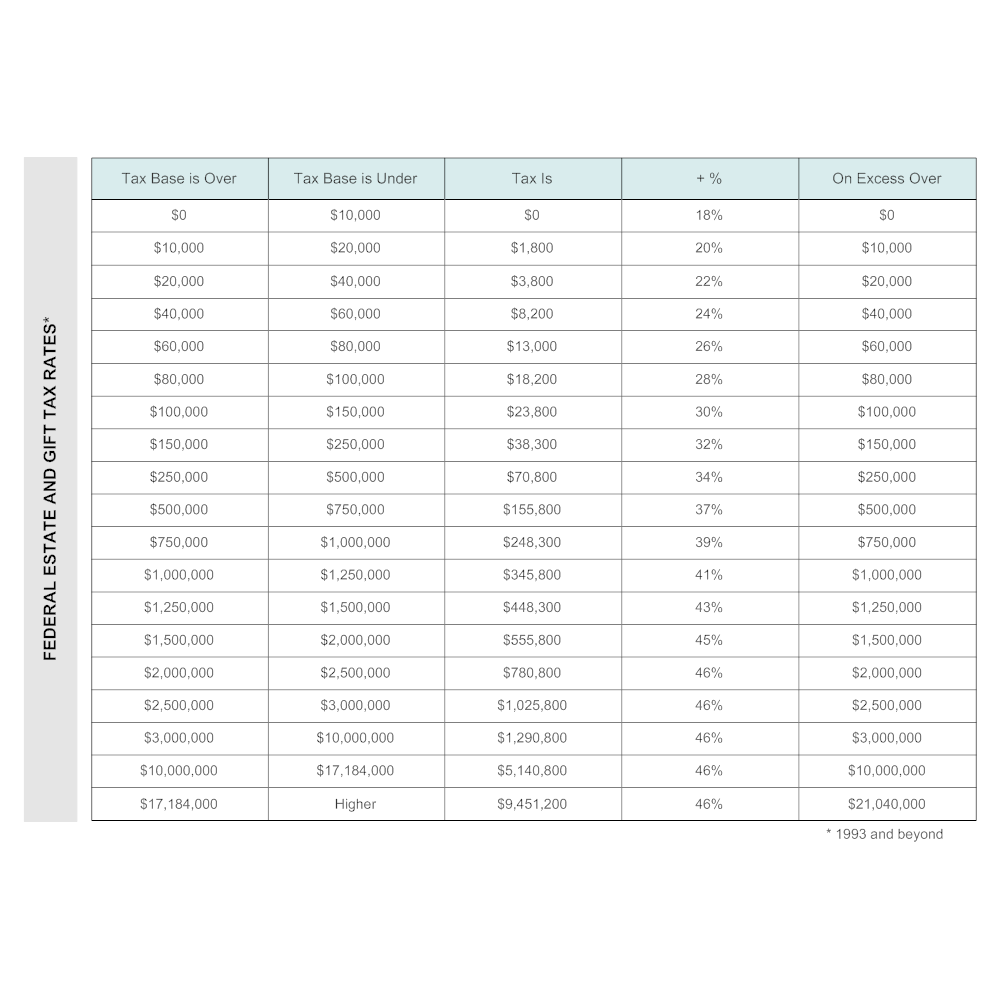

Source: www.smartdraw.com

Source: www.smartdraw.com

Federal Estate and Gift Tax Rates, The lifetime gift tax exemption allows you to make large gifts without incurring gift taxes. A gift tax is a tax that can be imposed on the transfer of money or property from one person to another.

Source: wallethacks.com

Source: wallethacks.com

How Does the Gift Tax Work?, 50,000 per annum are exempt from tax in india. What you need to know.

Source: www.reacpa.com

Source: www.reacpa.com

Gift Tax Return Protection Business Valuation Rea CPA, In 2025, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million (twice that for couples making joint gifts). In 2025, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability.

The Parliament Of India Introduced The Gift Tax Act In 1958, And Gift Tax Is Essentially The Tax Charged On The Receipt Of Gifts.

To navigate federal gift tax, most people leverage exemptions.

In Addition, Gifts From Certain Relatives Such As Parents, Spouse.

With the increased exemption amount through 2025, certain lifetime gifting strategies can be implemented now, before the sunset, to reduce estate values and.